U.S. Debt Credit Rating Downgraded: ‘Standards of Governance’ Cited

Why did U.S. credit rating drop?

In the realm of global finance, credit ratings hold significant influence over investor sentiment and economic stability. Recently, one such event made headlines when Fitch Ratings downgraded the United States' credit rating. This downgrade was met with widespread concern as it directly affects the country's ability to borrow money and potentially impacts its overall economic standing on the international stage. At the center of this development is Janet Yellen, a prominent figure in American economics and former Chair of the Federal Reserve.

As Fitch Ratings made their decision, many analysts turned their attention to Yellen due to her vast experience and expertise in monetary policy. Janet Yellen's role in this context stems from her influential position as Treasury Secretary under President Joe Biden. With her extensive knowledge of financial markets and deep understanding of macroeconomic factors, Yellen plays a vital role in shaping America's economic policies.

Her involvement becomes even more

crucial

considering that credit rating agencies like

Fitch

rely on government policies and fiscal discipline when assessing a country's creditworthiness.

Fitch Downgrades U.S. Credit Rating - AAA to AA+

Fitch Ratings employs a comprehensive framework to evaluate credit risk by analyzing various factors such as economic conditions, fiscal policies, political stability, and debt sustainability. The agency assigns ratings ranging from AAA (highest quality) to D (default), allowing investors to gauge the level of risk associated with different issuers or securities. The downgrade decision for the United States reflects Fitch's concerns about long-term fiscal sustainability amid rising public debt levels.

What are the FITCH Credit Ratings ?

Fitch Ratings, THE

leading global credit rating agencies

, provides investors and market participants with an assessment of the creditworthiness of countries, corporations, and financial instruments. Their recent decision to downgrade the United States' credit rating has garnered significant attention. To comprehend the significance of this action, it is essential to understand Fitch Ratings' methodology and its impact on the financial markets.

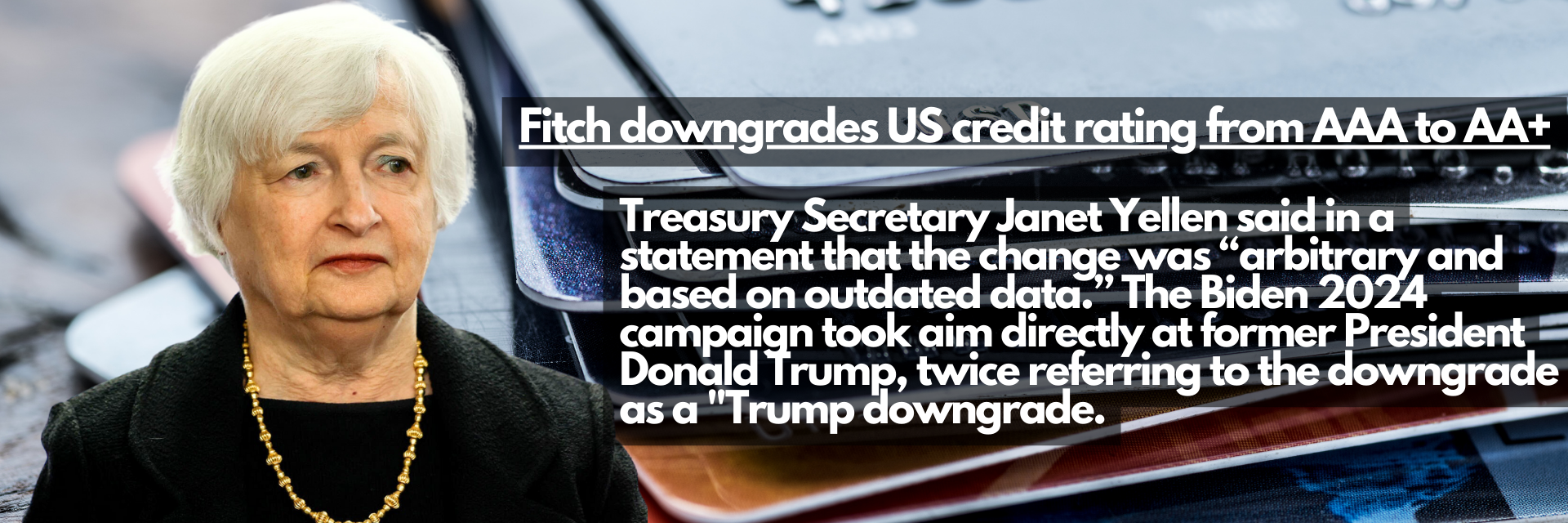

Biden White House Blaming Trump Administration for Credit Down Grade?

The Biden administration and his campaign are blaming the GOP for the recent downgrade by Fitch Ratings, marking the first such downgrade for the U.S. in more than 10 years. Fitch lowered the U.S. debt rating from AAA to AA+ following a standoff in Congress earlier this year that put the country at risk of defaulting on its debt. The ratings agency also cited the January 6 riot as a factor for the decision. Fitch's Americas Sovereign Ratings co-head, Richard Francis, told CNBC that there has been a troubling decline in governance over the past few decades, which was typified by the January 6 events. White House press secretary Karine Jean-Pierre expressed strong disagreement with the downgrade, which she claimed to be at odds with reality given what she described as the strongest economic recovery in the world under President Biden. She blamed Republican extremism - through endorsing default, undermining governance and democracy, and promoting tax cuts that increase the deficit and benefit the wealthy and corporations – for continually threatening the economy.

It underscores potential challenges in meeting future obligations and maintaining economic stability over time. This action can influence borrowing costs for both the government and private sector entities within the country. Furthermore, Fitch Ratings' decisions hold immense significance because they impact investor confidence and market sentiment worldwide. A credit downgrade can trigger increased market volatility as investors reassess their portfolio allocations based on perceived risks associated with downgraded entities or countries.

What Downgrading of US Credit Score Mean for Americans?

According to Fitch Ratings:

The downgrade in the United States' rating portrays the expected financial decline over the next three years, an increasing and heavy general government debt burden, and the deterioration of governance in comparison with 'AA' and 'AAA' rated counterparts over the last two decades. This has been apparent through multiple instances of political deadlock over the debt limit and delayed resolutions.

Erosion of Governance: Fitch perceives a consistent decline in governance standards over the past 20 years, including in regards to fiscal and debt matters. This persists despite the bipartisan agreement in June to suspend the debt limit until January 2025. Frequent political deadlock over the debt limit, coupled with delayed resolutions, have weakened faith in financial management. Moreover, unlike most of its counterparts, the government lacks a medium-term financial framework and has a complicated budgeting process. These factors, paired with various economic disturbances, tax reductions and new spending initiatives, have resulted in successive increases in debt over the past decade. There has also been negligible progress in addressing medium-term challenges linked to increasing social security and Medicare costs due to a greying population.

When did U.S. credit rating get downgraded?

U.S. credit has been downgraded on two major occasions:

1. On August 5, 2011, Standard & Poor’s (S&P) downgraded the U.S.' credit rating for the first time in history from AAA to AA+, mainly due to concerns about the government's budget deficit and rising debt burden.

2. Following the first instance, another downgrade happened in 2023 On August 1, 2023, the US credit rating was downgraded from AAA to AA+ by Fitch Ratings, one of only three private credit rating firms. Its decision affirms what Republicans have been cautioning about: The current debt and spending levels are not sustainable. Rising interest costs and increased inflation and interest rates have negatively impacted our economy. A forecasted recession by year-end raises further concerns. The financial outlook continues to worsen and the debt-to-GDP ratio has impaired the US’s capacity to withstand future financial crises. The firm warns that unless changes are made, another credit downgrade could be on the horizon, potentially undermining the status of the US dollar as the global reserve currency.

It's important to note that the other two major credit rating agencies, Moody's and Fitch, have maintained their AAA rating for the U.S. so far

Reasons Behind Fitch's Credit Downgrading of United States:

Fitch's recent decision to downgrade the credit rating of the United States has significant implications for the country's economy. This downgrade, which reflects a decrease in confidence in the nation's ability to meet its financial obligations, could have far-reaching consequences. Firstly, a lower credit rating may lead to an increase in borrowing costs for the US government. As investors become more wary of lending money to a riskier borrower, they may demand higher interest rates on Treasury bonds.

This would result in higher interest payments on outstanding debt and potentially strain the federal budget. Secondly, a credit downgrade could impact consumer and investor confidence. When a nation's creditworthiness is called into question, it can create uncertainty and dampen economic activity. Businesses may delay investments or hiring decisions due to concerns about future economic stability. Additionally, Fitch's downgrade may affect international perceptions of US leadership and influence.

The United States has long been seen as a global economic powerhouse, but this reassessment could undermine its standing on the international stage. It may erode confidence in the US dollar as a reserve currency and weaken its position in trade negotiations or diplomatic discussions. In conclusion, Fitch's decision to downgrade the US credit rating carries significant implications for the country's economy.

The Implications Of Fitch's Downgrade For The Us Economy

The Implications Of Fitch's Downgrade For Jerome Powel and Jannet Yellen Involvement

Janet Yellen , the former Chair of the Federal Reserve, played a pivotal role in the decision-making process that led to Fitch Ratings' credit downgrade of the United States. As one of the most influential figures in global finance, her insights and expertise were crucial in determining the country's creditworthiness. Yellen's involvement began when Fitch Ratings approached her for her opinion on the state of the US economy and its potential impact on its credit rating.

The implications of a credit downgrade instigated by Fitch's Ratings, or any major credit rating agency, are significant for Federal Reserve Chair, Jerome Powell, and U.S. Treasury Secretary, Janet Yellen. The central role of these individuals in establishing and advocating for U.S. fiscal and monetary policy means that any downgrade signals a negative outlook on a country's debt profile and economic strength.

1. Decreased Confidence: A downgrade suggests that Fitch's Ratings believes there is a greater risk that the U.S. might not meet its debt obligations. This can harm investor confidence and lead to increased borrowing costs. As key figures in U.S. financial policy, Powell and Yellen may face intense scrutiny and criticism over their handling of the economy.

2. Fiscal Policy Challenges: Janet Yellen, as Treasury Secretary, would need to navigate the challenges of increased borrowing costs at a time when fiscal stimulus may still be necessary to support the recovery from the pandemic. This could mean advocating for long-term fiscal sustainability through spending cuts or tax increases, which may be politically unpopular.

3. Monetary Policy Constraints: As for Jerome Powell, a credit downgrade could limit the Federal Reserve's options. If investor confidence suffers and the markets become turbulent, the Federal Reserve may need to use its policy tools to stabilize the markets. But with interest rates already at historically low levels, it is not a simple task. A downgrade could therefore lead to tighter financial conditions and slow economic recovery.

4. Need for Policy Adjustments: Both Yellen and Powell would likely need to reassure investors by demonstrating concrete plans for improving the U.S.'s fiscal position and thus regaining the lost credit rating. This might involve making hard decisions regarding spending, taxes, and monetary policy.

5. Global Economic Repercussions: A Fitch downgrade for the US, given its role as the world's economic powerhouse, could potentially lead to global financial turmoil. Such an event would require strong leadership, coordination, and action from Powell and Yellen, alongside their global counterparts, to ensure economic stability.

6. Domestic Political Pressure: Lastly, there will be increased domestic political pressure on Yellen and Powell to stabilize the economy, increase employment rates, and manage inflation.

Given her extensive experience in monetary policy and deep understanding of economic indicators, Yellen provided valuable insights into various factors contributing to a possible downgrade. During discussions with Fitch analysts, Yellen emphasized concerns about mounting government debt, sluggish economic growth, and political uncertainties. Her assessment highlighted these issues as potential risk factors that could negatively impact the country's credit rating. Yellen's analysis was based on a comprehensive understanding of macroeconomic trends and her nuanced grasp of financial markets.

Additionally, Yellen's reputation as a respected economist added weight to Fitch Ratings' decision-making process. Her involvement lent credibility to their evaluation by incorporating an expert viewpoint from someone who had previously held one of the highest positions within US monetary policy.

Second time President Biden has Presided over a US credit Downgrade

The recent credit downgrade by Fitch Ratings has once again put the spotlight on the financial health of the United States. This decision by Fitch to lower the country's credit rating from AAA to AA+ reflects concerns over several key factors that have contributed to a growing fiscal imbalance. One of the primary reasons behind this downgrade is the mounting national debt.

The US has been grappling with a significant increase in its debt levels over the past decade, reaching unprecedented heights. This upward trajectory poses serious challenges for long-term economic stability and raises questions about the government's ability to manage its finances effectively. Another factor influencing Fitch's decision is political gridlock and uncertainty surrounding fiscal policy. The constant battles between Democrats and Republicans over issues like budgetary allocations, taxation, and government spending have resulted in frequent delays in passing crucial legislation.

Such political volatility makes it difficult for Fitch to have confidence in a stable economic outlook for the nation. Furthermore, Fitch has expressed concerns about economic inequality within the United States. The growing wealth gap between different segments of society raises social and political tensions and can potentially undermine economic growth prospects in the long run. Overall, these factors collectively contribute to a less favorable assessment of America's creditworthiness by Fitch Ratings.

US Credit Downgraded to AA+ by Fitch: Bidenomics

As news of Fitch's decision spread, stock markets around the world experienced a sharp decline. Investors quickly moved their funds away from riskier assets such as equities and into safer havens like government bonds and gold. Yellen noted that a credit downgrade can lead to higher interest rates on government debt, making it more expensive for the US government to borrow money and potentially stifling economic growth.

Fitch Ratings' decision to downgrade the credit rating of the United States has sparked a flurry of expert opinions regarding its potential implications and Federal Reserve Chair Janet Yellen's influence on the matter. Many financial experts argue that Fitch's credit downgrade is a significant blow to the reputation of the United States as a global economic powerhouse. They believe that such a downgrade could raise borrowing costs for the government, leading to increased interest payments on its debt, which could potentially strain the country's fiscal position.

Some experts also express concerns about its impact on investor confidence in U.S. Treasuries, as these securities are considered one of the safest investments globally. Regarding Janet Yellen's influence, some experts believe that her policies as Federal Reserve Chair played a role in Fitch's decision. Yellen has been known for maintaining an accommodative

monetary policy

stance during her tenure, which some argue may have contributed to rising inflationary pressures in recent months.

The United States' Long-Term Credit Ratings Downgraded to 'AA+' from 'AAA'.Outlook for future is Stable?

In conclusion, the decision by Fitch Ratings to downgrade the US credit rating has significant long-term implications for the country's economy and financial stability. While it is crucial not to overstate the immediate impact of this downgrade, as other major credit rating agencies have maintained their AAA ratings for the United States , there are still several factors that warrant careful consideration.

Firstly, a credit downgrade can potentially increase borrowing costs for the government and corporations alike. Higher interest rates would result in increased debt burdens and reduced investment, which could hinder economic growth in the long run. This could further exacerbate existing challenges such as income inequality and unemployment. Secondly, a lower credit rating may undermine investor confidence in US Treasury bonds as a safe haven asset.

This could lead to a decline in demand for these bonds from foreign investors, resulting in higher yields and reduced liquidity in global financial markets. Lastly, a downgraded credit rating may weaken America's position as a global economic leader. It could diminish its influence on international trade negotiations and limit its ability to act as a stabilizing force during periods of economic uncertainty.

This could have influenced Fitch's assessment of U.S. creditworthiness. However, others point out that while Yellen may have influenced short-term market dynamics through her policies, she alone cannot be held responsible for Fitch's credit downgrade. They emphasize that multiple factors contribute to such decisions, including fiscal policies, political uncertainties, and structural economic challenges.